High Value Health Care

We’re spending too much money on healthcare, and getting too little in return.

Have you ever wondered whether you’re getting your money’s worth when it comes to health insurance and health care?

You’re not alone and you have good reason to wonder. Our health care system is riddled with perverse incentives that increase costs without improving quality. And it’s almost impossible to “shop around.” Not only is it hard to be a smart consumer when you’re in need of immediate health care, comparing costs and value among providers requires the instincts of a good detective, a familiarity with medical jargon, and more time and patience than the average person has on their hands.

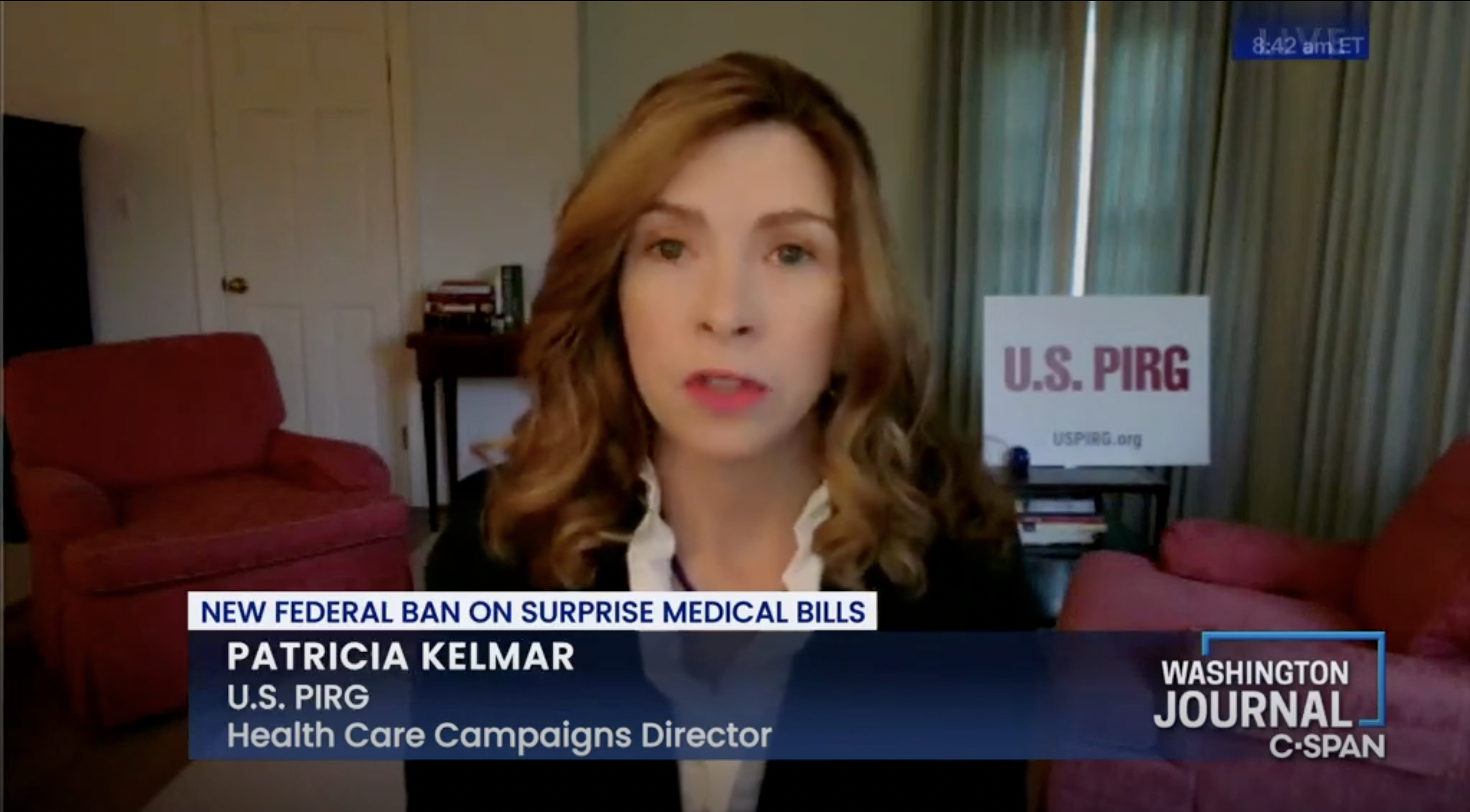

Our staff, members and supporters are working to solve these problems. We’re calling for an end to abuses of the patent system which keep lower-cost generic drugs out of the hands of doctors and their patients. We won a law to end most out-of-network “surprise” medical bills and now we’re working to make sure state regulators enforce it. And we’re calling attention to the negative effects that private equity investments and large hospital mergers have on costs and the quality of care.

Updates

Medical Credit Cards: Are they a good deal?

Medical Bills: Everything you need to know about your rights.

Nearly $5,000 of medical debt is crippling 1 in 10 adults

Find Out More

Were you charged a ‘facility fee’ on your medical bill?

PIRG builds on campaign to improve hospital price transparency to drive down high prices in health care

Facility fees are driving up the prices of doctor visits.