Deirdre Cummings

Legislative Director, MASSPIRG

617-747-4319

[email protected]

Legislative Director, MASSPIRG

617-747-4319

[email protected]

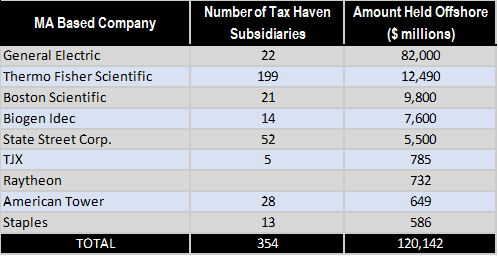

In 2016, 73 percent of Fortune 500 companies – including General Electric and Boston Scientific headquartered in Massachusetts maintained subsidiaries in offshore tax havens, according to “Offshore Shell Games,” released today by MASSPIRG Education Fund and the Institute on Taxation and Economic Policy. Collectively, multinationals reported booking $2.6 trillion offshore, with just 30 companies accounting for 68 percent of this total, and just four companies accounting for a quarter of the total, resulting in an estimated $750 billion in U.S. federal tax avoidance.

“With Congress looking to pass tax cuts that would cost upwards of $5 trillion, it’s all the more unacceptable to leave open these absurd loopholes and gimmicks for the biggest multinational corporations,” said Deirdre Cummings, Legislative Director with MASSPIRG. “Tax reform should inject common sense into our tax code, and it shouldn’t balloon our deficit. Closing tax haven loopholes would both eliminate some of the most ridiculous tax gaming and it could help pay for the cost of tax cuts.

General Electric for example, headquartered in Boston, holds $82 billion in 22 offshore tax havens including the Bahamas, Bermuda and Luxembourg.

“The rules are already rigged against local businesses. A small company isn’t booking its money to some Cayman Islands holding company, they just pay what they owe. Why should they have to compete with another company who isn’t paying the same taxes?” said Massachusetts Fair Share State Director Nathan Proctor. “Rep. Richard Neal, as the top ranking democrat on the critical tax writing committee, is at the epicenter of this debate. He has the chance to stand for a tax code where everyone plays by the same rules.”

Key findings of the report include:

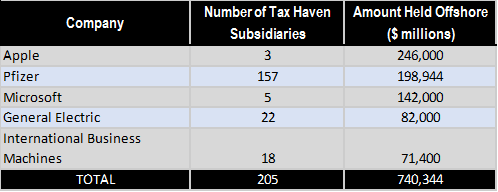

The top 5 companies by total amount held offshore.

● The 30 companies with the most money booked offshore for tax purposes collectively hold nearly $1.76 trillion overseas, increased since last year. That is 67 percent of the nearly $2.6 trillion that Fortune 500 companies together report holding offshore.

● Only 58 Fortune 500 companies disclose what they would expect to pay in U.S. taxes if these profits were not officially booked offshore. In total, these 58 companies would owe $240 billion in additional federal taxes, more than 5 times the annual state budget for Massachusetts. The average tax rate the 58 companies currently pay to other countries on this income is a mere 6.1 percent, implying that most of it is booked to tax havens.

“Real tax reform would fix the deferral loophole, not reward companies for using the loophole to avoid taxes year after year,” said Richard Phillips, a senior policy analyst at the Institute on Taxation and Economic Policy. “Lawmakers shouldn’t be discussing how to sweeten the pot and give corporations a huge tax break that amounts to a huge financial reward for engaging in bad corporate behavior.”

The report concludes that to end tax haven abuse, Congress and state legislatures should end incentives for companies to shift profits offshore, close the most egregious offshore loopholes, strengthen tax enforcement, increase transparency, and deny corporations a repatriation holiday.

And while much of the reform necessary to stop this offshore tax dodging must happen at the federal level, states can still act to curb some of the worst abuses. By closing these loopholes on the state level, Massachusetts could save $79 million a year. An Act closing a corporate tax haven loophole, HB 1501 and SB 1569 filed by Representative Josh Cutler (Duxbury) and Senator Mark Montigny (Montigny) and cosponsored by a bipartisan group of 49 lawmakers is pending in the Massachusetts legislature. The bill, already a law in place in Oregon and Montana, is known as the “water’s edge” loophole and would require that companies treat profits made in Massachusetts and funneled to known tax havens like the Cayman Islands as domestic taxable income.

You can find the report here: https://masspirgedfund.org/reports/maf/shore-shell-games

-30-

MASSPIRG is a non-profit, non-partisan public interest advocacy organization that stands up to powerful interests whenever they threaten our health and safety, our financial security, or our right to full participate in our democratic society. On the web at www.masspirg.org.

Massachusetts Fair Share is statewide nonprofit group that stands for an America where everyone gets their fair share, does their fair share, and pays their fair share; and where everyone plays by the same rules. https://www.fairshareonline.org/massachusetts-fair-share