MA Receives an “A-” in Annual Report on Transparency of Government Spending

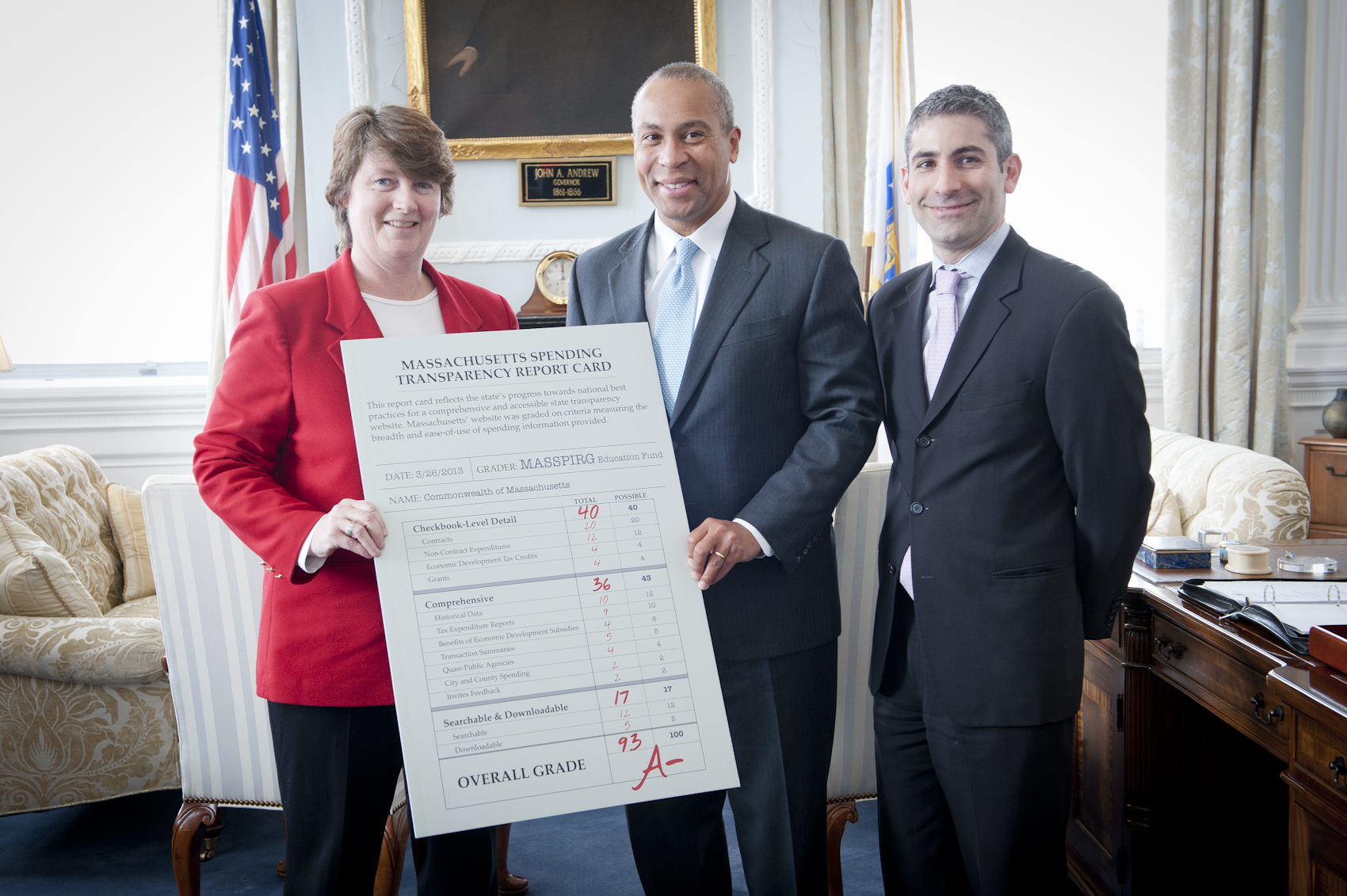

MASSPIRG’s Legislative Director, Deirdre Cummings, presents Governor Patrick with report card on state spending transparency. Secretary of Administration and Finance, Glen Shor, looks on.

BOSTON, March 26 – Massachusetts received an “A-” when it comes to government spending transparency, according to “Following the Money 2013: How the States Rank on Providing Online Access to Government Spending Data,” the fourth annual report of its kind by the Massachusetts Public Interest Research Group (MASSPIRG) Education Fund.

“A- is pretty good, but A+ is better,” said Governor Deval Patrick. “Massachusetts has never had more transparency in state government, and I am proud of that; but our citizens deserve to have us work even harder to leave behind a truly results-oriented, accountable government.”

“State governments across the country continue to be more transparent about where the money goes, extending checkbook-level disclosure of data on spending to contracting, tax subsidies, development incentives and other expenditures,” said Deirdre Cummings, Legislative Director of MASSPIRG. “Massachusetts’ spending website is one of the best in the country when it comes to making state spending transparent and accessible.”

Officials from Massachusetts and 47 other states provided the researchers with feedback on their initial evaluation of state transparency websites. The leading states, in order, with the most comprehensive transparency websites are: Texas, Massachusetts, Florida, Illinois, Kentucky, Michigan, and Oklahoma.

Based on an inventory of the content and ease-of-use of states’ transparency websites, “Following the Money 2013” assigns each state a grade from “A” to “F.” The report describes Massachusetts as a “leading state” because the user-friendly website allows users to monitor the payments made to vendors through contracts, grants, tax credits and other discretionary spending. The website provides access to municipal websites sites, includes spending details from some independent or quasi public entities, and allows for user feedback. Equally impressive, relative to other states’ websites, is the fact that the website very clearly discloses what it does and does not include.

While this is the second consecutive year that Massachusetts’ transparency website has earned an “A-” it is important to note our surveys get more difficult each year as technology improves and consumer expectations increase. Last year, Massachusetts was ranked 4th best in the country with a 92, and this year they have improved to 2nd best with a 93. Massachusetts was awarded an “F” in MASSPIRG’s first survey in 2010.

“I am proud of all the work that we have done to make it possible for residents to become more fully engaged regarding how their government operates,” said Secretary of Administration and Finance Glen Shor. “We are pleased that MASSPIRG’s report applauds our efforts to increase transparency in state spending.”

Since last year’s “Following the Money” report, there has been remarkable progress across the country with new states providing online access to government spending information and several states pioneering new tools to further expand citizens’ access to government spending information.

One of the most striking findings in this year’s report is that all 50 states now provide at least some checkbook-level detail about individual government expenditures. In 48 states—all except California and Vermont—this information is now searchable. Just three years ago, only 32 states provided checkbook-level information on state spending online, and only 29 states provided that information in searchable form. Thirty-nine state transparency websites now include tax expenditure reports, providing information on government expenditures through tax code deductions, exemptions and credits—up from just eight states three years ago.

“Posting information about each government transaction has become the universal standard, as it should be,” said Cummings. “Citizens expect government information at their fingertips the way cell phone minutes or the location of a package can be easily pulled up. Putting spending information online helps hold government accountable and allows taxpayers to see where the money goes.”

The states with the most transparent spending stand out partly because they are comprehensive about the kinds of spending they include, disclosing data on economic development subsidies, expenditures granted through the tax code, and quasi-public agencies—recognizing that these items affect budget trade-offs just as traditional spending does. At least six states have launched brand new transparency websites since last year’s report. Most made improvements that are documented in the report. But the best states have transparency tools that are highly searchable, include detailed usable information, and engage citizens—allowing all the information to be put to good use.

States that have created or improved their online transparency have typically done so with little upfront cost. In fact, top-flight transparency websites can save money for taxpayers, while also restoring public confidence in government, and preventing misspending and pay-to-play contracts.

“Public budgets are the most concrete expression of public values and priorities—articulated in dollars and cents. As we grapple with difficult decisions to make budgetary ends meet, opening the state checkbook to the public provides an important tool that allows both citizens and civil servants to make informed choices,” concluded Cummings.

To access Massachusetts’ spending transparency website, http://www.mass.gov/transparency/